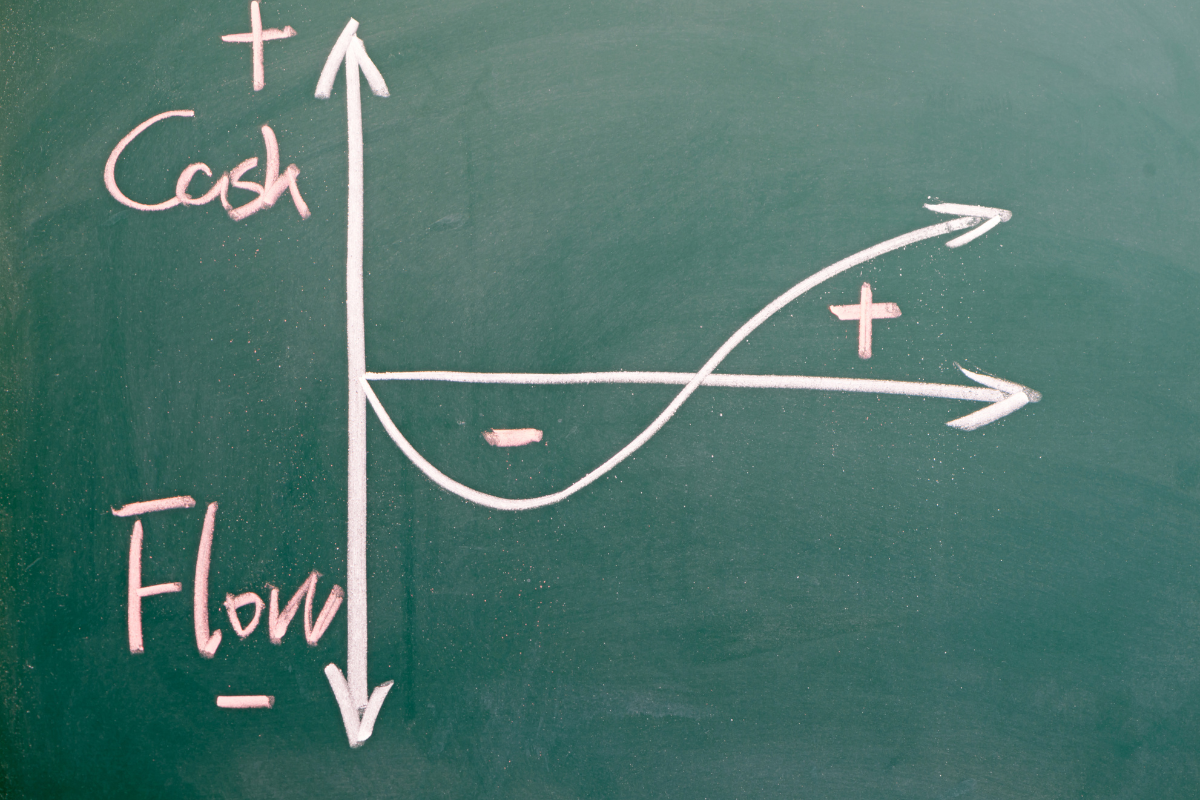

In auto dealer finance, that old saying “cash is king,” still rings true. Understanding and managing cash flow is a fundamental part of running a successful auto dealership. It’s all about ensuring a steady stream of cash into and out of your business to maintain smooth operations.

A positive cash flow ensures that your dealership has the financial agility to seize opportunities, adapt to market changes, and deliver exceptional value to your customers. Here are some best practices to keep your dealership’s cash flow robust and your business flourishing.

Understanding Cash Flow in a Used Car Dealership

Cash is the lifeblood of any business, and it holds particular importance for a used car dealership. It refers to the movement of money in and out of your dealership on a regular basis, and it plays a crucial role in the financial health and stability of your business

There are different types of cash flow that you need to understand as a used car dealership owner:

- Operating cash flow involves the day-to-day operations of your dealership. This includes cash inflows from car sales, parts and service revenue, and other income sources, as well as cash outflows for expenses like rent, utilities, and employee salaries.

- Investing cash flow refers to the buying and selling of assets, such as acquiring new vehicles for your lot or selling off older models. It’s important to carefully manage your investing cash flow to ensure you’re making smart decisions that positively impact your bottom line.

- Financing cash flow involves any borrowing or lending activities your dealership engages in. This could include loans taken out to purchase vehicles or leasing agreements with financial institutions. It’s essential to keep a close eye on your financing cash flow to ensure you’re managing your debts responsibly.

To effectively manage your dealership’s revenue, there are 2 key metrics you should measure and monitor.

- Cash conversion cycle, which measures the time it takes for cash to flow in and out of your business. By reducing the cash conversion cycle, you can improve the efficiency of your cash flow and increase your dealership’s financial health.

- Operating cash flow ratio, which compares your dealership’s cash inflows to its cash outflows. This ratio helps you determine if you have enough cash on hand to cover your operating expenses and make necessary investments.

Optimizing Inventory for Maximum Turnover

Managing inventory turnover is crucial for maintaining a healthy cash flow as a used car dealership. By effectively managing your inventory, you can ensure that your capital is not tied up in stagnant vehicles.

BONUS RESOURCE→ Read “What should independent auto dealers consider before liquidating aged auto inventory?”

To improve, be sure to focus on implementing strategies that maximize inventory turnover. This includes closely monitoring the average time it takes to sell a vehicle and actively working to reduce it. This means you’ll need to analyze your sales data to identify the most popular models for your market and adjust your inventory accordingly. Additionally, you might also consider offering incentives for your sales team to sell vehicles quickly, such as bonuses or commissions based on turnover rates.

Growing your dealer inventory is another area where cash flow is super important. When dealers choose to acquire vehicles using cash (i.e. their dealership revenue) it can severely limit purchasing power.

However, with the right floorplan financing option, dealers won’t need to tie up a large amount of capital to acquire inventory. Instead, they can use floorplan financing to purchase vehicles, which allows them to keep more cash on hand for other operational needs or investment opportunities.

By providing a flexible and efficient way to finance inventory purchases, floorplan financing can assist used car dealerships to navigate the challenges of cash flow management more effectively, contributing to their overall financial health and operational success.

BONUS RESOURCE→Learn more about floorplan financing in our recent blog post!

Plan and Forecast Your Finances

Effective financial planning and forecasting are crucial for maintaining a healthy cash flow as a used car dealership. By creating a financial forecast, you can gain better visibility and make more informed decisions.

Here are some key steps to consider:

1. Creating a cash flow forecast for better financial planning:

Start by analyzing your historical data, including sales, expenses, and cash flow patterns. This will help you identify trends and seasonal fluctuations that can impact your cash flow. Use this information to create a detailed forecast that projects your income and expenses over a specific period, such as a month or a quarter. A cash flow forecast will enable you to anticipate potential cash shortages or surpluses, allowing you to take proactive measures.

2. Identifying potential cash flow gaps and taking proactive measures:

Review your cash flow forecast regularly to identify any potential gaps between your projected income and expenses. If you anticipate a cash shortage, consider implementing measures such as adjusting your inventory levels, renegotiating payment terms with suppliers, or exploring financing options. By taking proactive measures, you can bridge any cash flow gaps and ensure a healthy financial position.

3. Utilizing financial tools and software for accurate forecasting:

Consider using financial tools and software specifically designed for cash flow forecasting. These tools can streamline the process, automate calculations, and provide you with accurate forecasts. By leveraging technology, you can save time and improve the accuracy of your financial planning, enabling you to make more informed decisions.

Choose AFC’s floorplan financing for used auto dealers

At AFC, we know first-hand the importance of healthy cash flow at used auto dealerships. Cash gets tied up in things like on-lot inventory, dealership facilities improvements, and even payroll. When cash on hand is limited, it can become a problem fast.

With floorplan funding from AFC, a dealer can turn existing inventory from just a cost source into a valuable asset. You can then borrow against that inventory and pay it off as they sell, eliminating the need for cash at the time of purchase.

Ready to start conquering your cash flow problems? Contact AFC to start your application for floorplan financing today!

“AFC” refers to Automotive Finance Corporation, AFC Cal, LLC and Automotive Finance Canada Inc. in their respective jurisdictions. All California transactions are through AFC Cal, LLC. California loans will be made pursuant to California Department of Financial Protection and Innovation Lenders License. All Canadian transactions are through Automotive Finance Canada Inc.

The afc logo is a trademark of Automotive Finance Corporation, an Indiana corporation, licensed to its affiliates.© 2024 Automotive Finance Corporation. All rights reserved.